Four Years After the Pandemic, Work-From-Home Trends Reshape Residential Choices and Real Estate

Four years after the pandemic began in March 2020, much of daily life has returned to normal; mask mandates have been lifted, people gather in large numbers for concerts and conferences, and the unemployment rate has returned to pre-pandemic levels. Yet, one legacy of COVID-19 – the shift towards remote work – remains a significant feature of the U.S. economy. This blog post will explore the current state of remote work and its impact on the real estate market.

Four years after the pandemic began in March 2020, much of daily life has returned to normal; mask mandates have been lifted, people gather in large numbers for concerts and conferences, and the unemployment rate has returned to pre-pandemic levels. Yet, one legacy of COVID-19 – the shift towards remote work – remains a significant feature of the U.S. economy. This blog post will explore the current state of remote work and its impact on the real estate market.

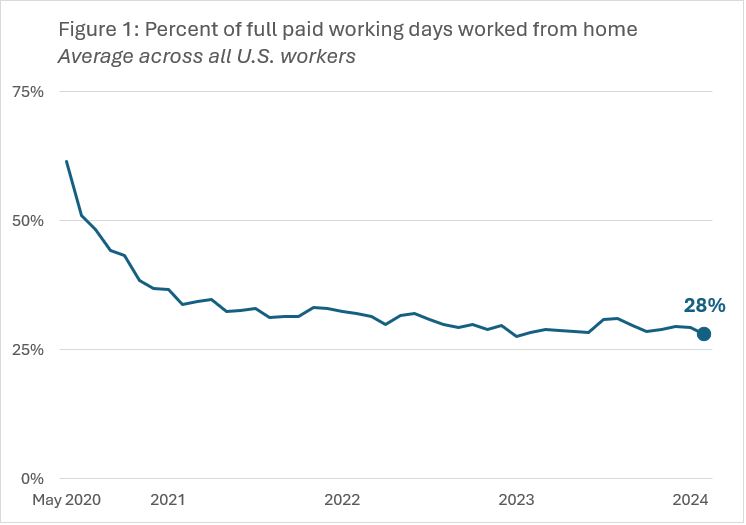

Work-from-home trends have stabilized since 2022. Data from the Survey of Working Arrangements and Attitudes (SWAA), which polls between 2,500 tand10,000 working-age U.S. residents, indicates that the average employee spends 28% of their full-paid workdays at home.[1] In 2024, between 25 and 30% of the U.S. workforce work in hybrid workplaces, while 13% work fully remotely.

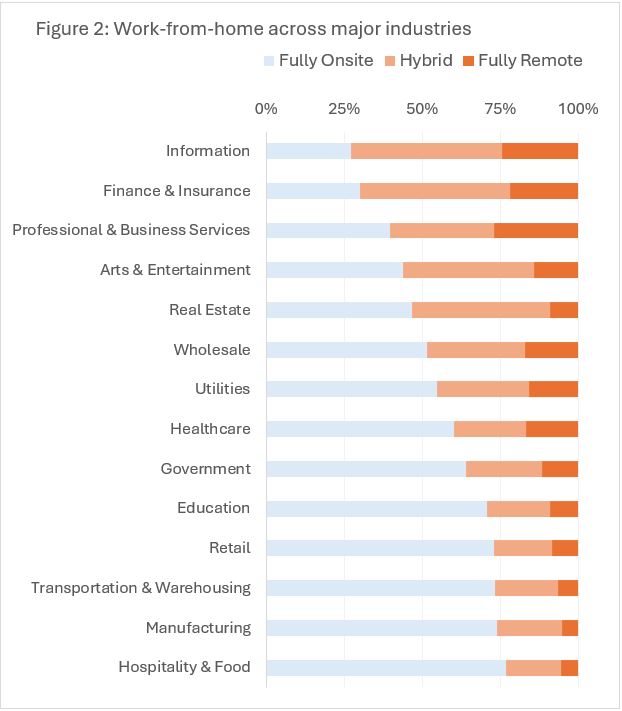

The prevalence of remote work varies significantly by sector. In industries such as finance, information, and real estate, more than half of employees work from home at least some of the time.

Work-from-home flexibility has also influenced residential choices. According to the WFH Research, which oversees the SWAA survey, the average distance from the workplace rose from 10 miles in January 2020 to over 25 miles in 2023.[2] Among employees who were hired after March 2020, the average commuting distance reached 35 miles in 2023, compared to 15 miles for those hired before the pandemic. This trend is most pronounced among individuals in their thirties and for households making over $100,000 a year.

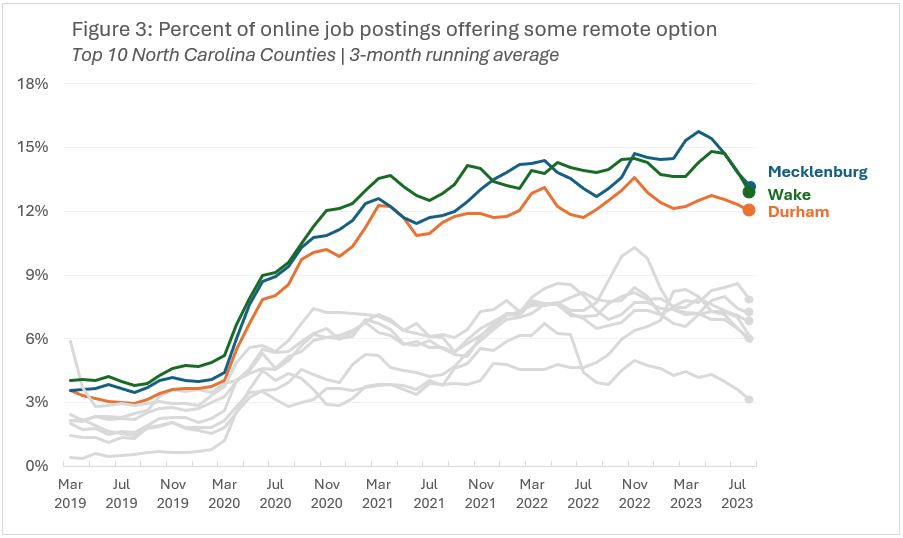

Job listings suggest that the Triangle and Charlotte areas will continue to offer work-from-home flexibility. More than 1 in 10 online job postings in Durham, Wake, and Mecklenburg guarantee some remote option to job applicants, the highest rate among other North Carolina counties.

This shift correlates with demographic changes in North Carolina’s suburban communities. According to Census data analyzed by Carolina Demography, suburban counties in a metropolitan area like Johnston and Franklin in the Raleigh MSA or Lincoln and Union County in the Charlotte MSA saw faster population growth between 2022 and 2023 than Wake or Mecklenburg County.

Remote work’s impact on real estate

Persistent work-from-home flexibility has had substantial impacts on real estate, most evidently in the reduced demand for traditional office spaces in downtown areas. In the fourth quarter of 2023, the office vacancy rate in the Raleigh metro area hit 20%, aligning with the national average. In Uptown Charlotte, the office vacancy rate exceeded 18%, and leases for approximately 1.7 million square feet of office space are set expire in the next 18 months.

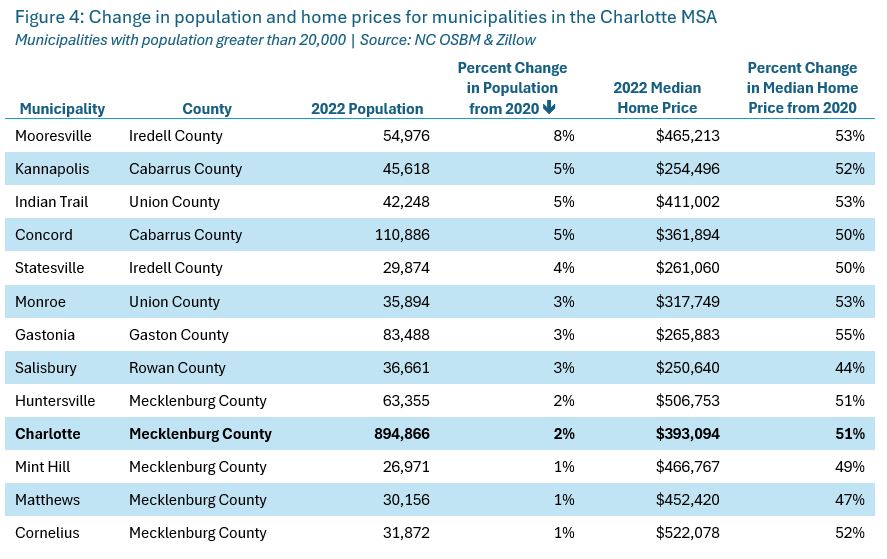

Conversely, demand for residential real estate has surged, partly fueled by remote work. According to one study by the Federal Reserve Bank of San Francisco, “the shift to remote work accounts for more than half of overall house price growth over the pandemic.” This is mirrored in local data for North Carolina. Between 2020 and 2022, Suburban communities outside of Mecklenburg County saw higher population increases and similar or greater home price growth compared to Charlotte and other municipalities within Mecklenburg County. It’s worth noting that the population change of these communities is not necessarily caused by the rise of remote work.

Like office buildings, retail establishments in the city center have been negatively impacted by the transition to work-from-home but have been more successful when located in residential areas with more remote workers. One study published in 2023 analyzed spending patterns among 70 million Chase customers from January 2017 to June 2022 to understand how work-from-home affected brick-and-mortar retail establishments. The study found that “on average, [retail] establishments in city centers have declined by 3.7 percent while establishments in neighborhoods at the inner and outer suburban rings have grown by an average of 1.1 and 0.3 percent, respectively, in the most recent data.”

[1] Barrero, Jose Maria, Nicholas Bloom, and Steven J. Davis, 2021. “Why working from home will stick,” National Bureau of Economic Research Working Paper 28731.

[2] Akan et al. Americans Now Live Farther from Their Employers. March 5, 2024. https://www.dropbox.com/scl/fi/00tqwffwrl1vcdz4jb6p9/DistanceToWork.pptx?rlkey=cy1sstv620nt696svtkkuai04&dl=0